Illinois Solar Rebates And Incentives

Top Solar Energy Programs In Illinois

Top Solar Energy Programs In Illinois

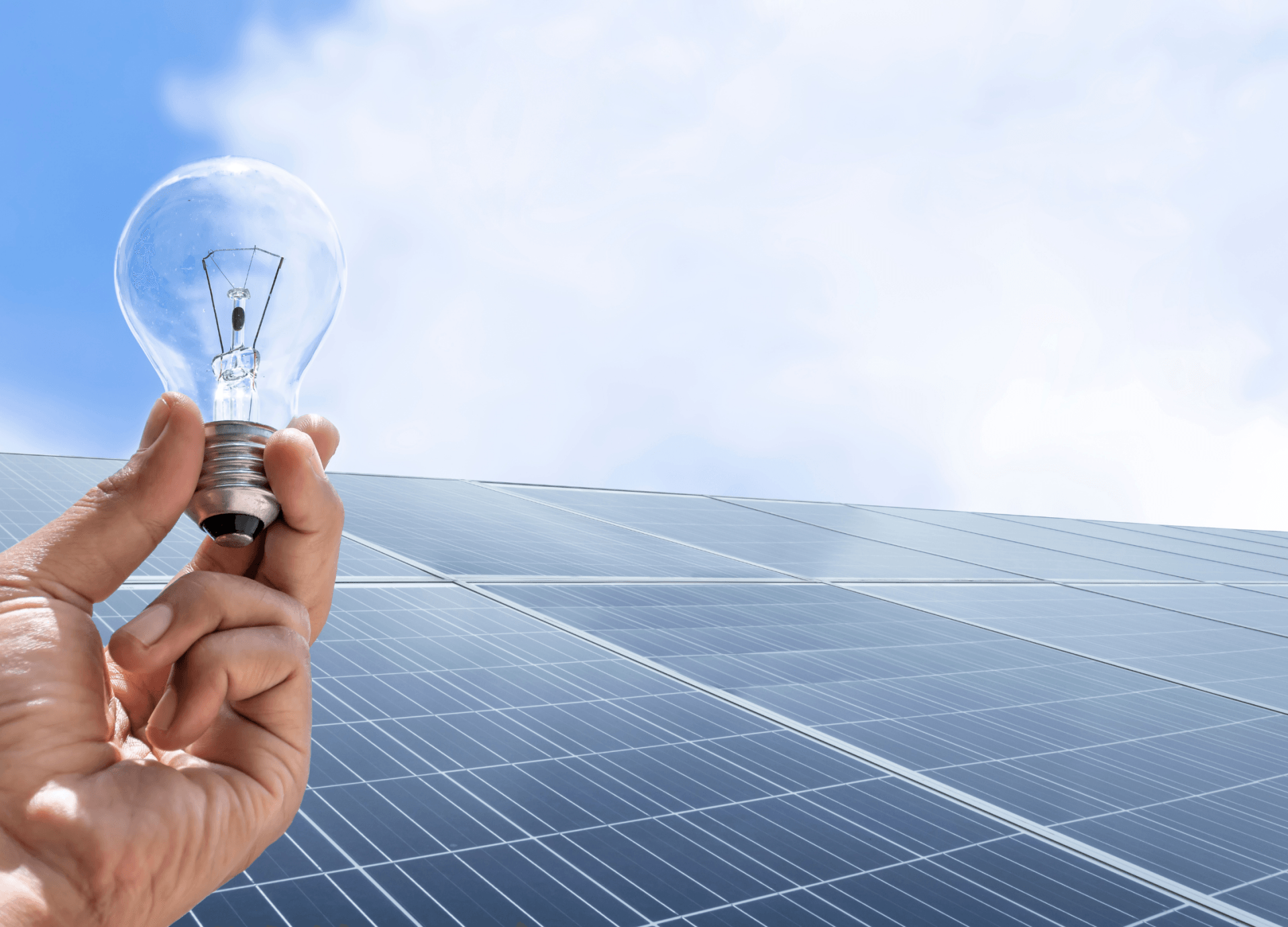

If you are planning to invest in solar energy in Illinois, you have come to the right place. Illinois has two solar energy policies that provide you with the biggest financial return on your investment.

Illinois' SREC Incentive - "The Adjustable Block Program"

Illinois Shines or the Adjustable Block Program lets you earn one SREC or solar renewable energy certificate for every megawatt-hour (MWh) of electricity that your solar panels produce over 15 years. In fact, the average homeowner can save up to $10,000 with this program.

Illinois Net Metering

The net metering policy lets the authorities buy back the excess electricity that your solar system produces. The net metering policy is a great way to balance the production and consumption of your solar system since it lets you benefit from the full value of your solar panels. The top utility net metering program is offered by Commonwealth Edison in Illinois.

ComEd Solar Rebates

ComEd or Commonwealth Edison is the largest utility company in the state. It provides rebates for industrial and commercial consumers, which helps reduce the out-of-pocket fees of installing solar panels. In fact, in case a ComEd customer decides to install solar panels on his or her business, he or she becomes eligible for a grant of $250 per kilowatt (kW) of installed solar power. Your solar system shouldn't be larger than 2,000 kW in capacity in order to receive this rebate.

Illinois Solar Tax Breaks

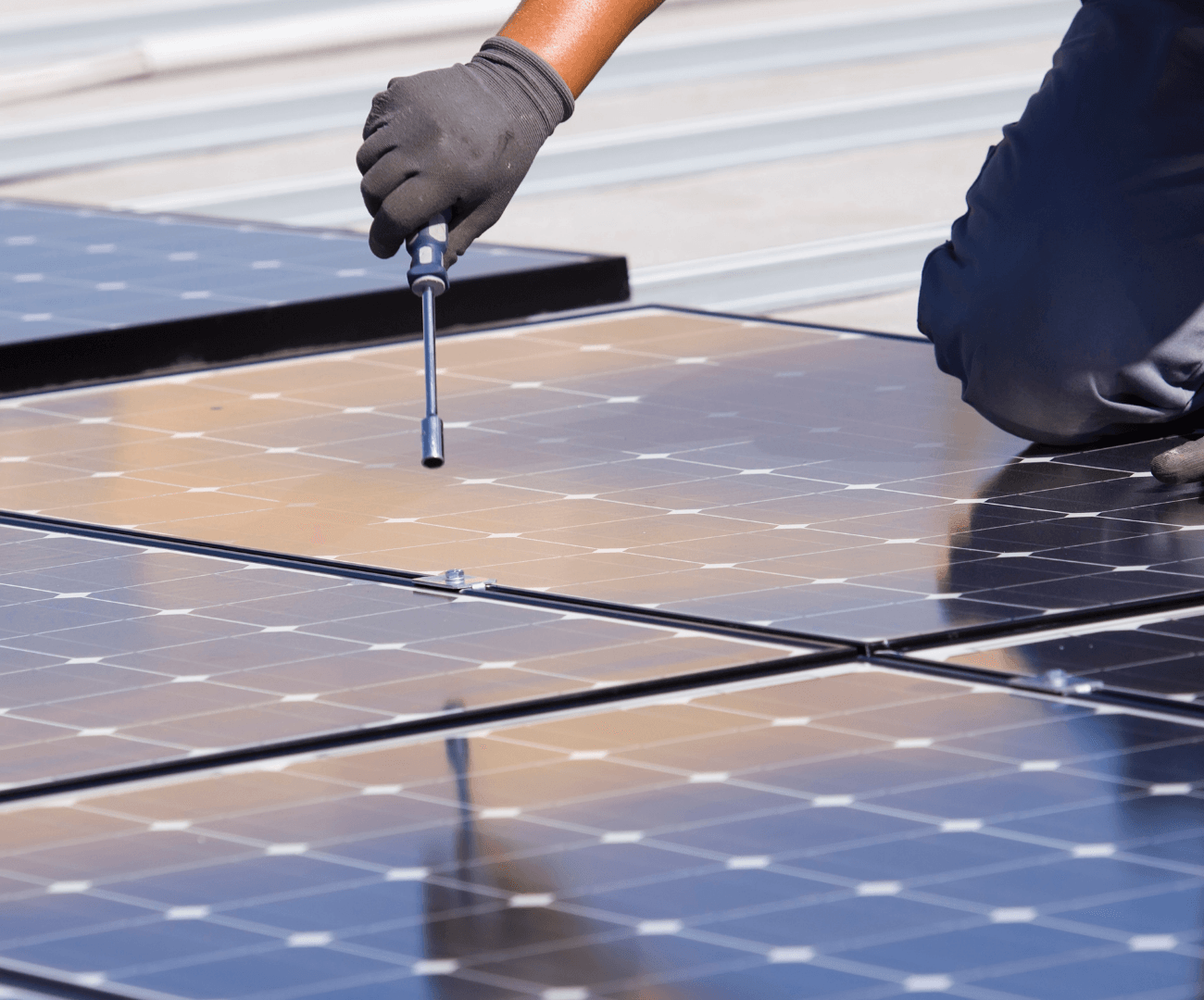

The following tax incentives are offered in Illinois to facilitate your decision of going solar.

Property Tax Break

You don't need to be worried that your property tax bill will increase as a result of installing a solar system on your property since the solar system won't be taken into consideration when taxing your property as per the Special Assessment for Solar Energy Systems.

The Federal Solar Tax Credit

There are also federal incentives for solar systems. For example, the Investment Tax Credit (ITC) lets you reduce the cost of the solar system by at least 26%. But the ITC applies only to people who have purchased their solar system outright - with a solar loan or a cash purchase. On the other hand, you should have enough income for the tax credit to be meaningful.