Missouri Solar Rebates And Incentives

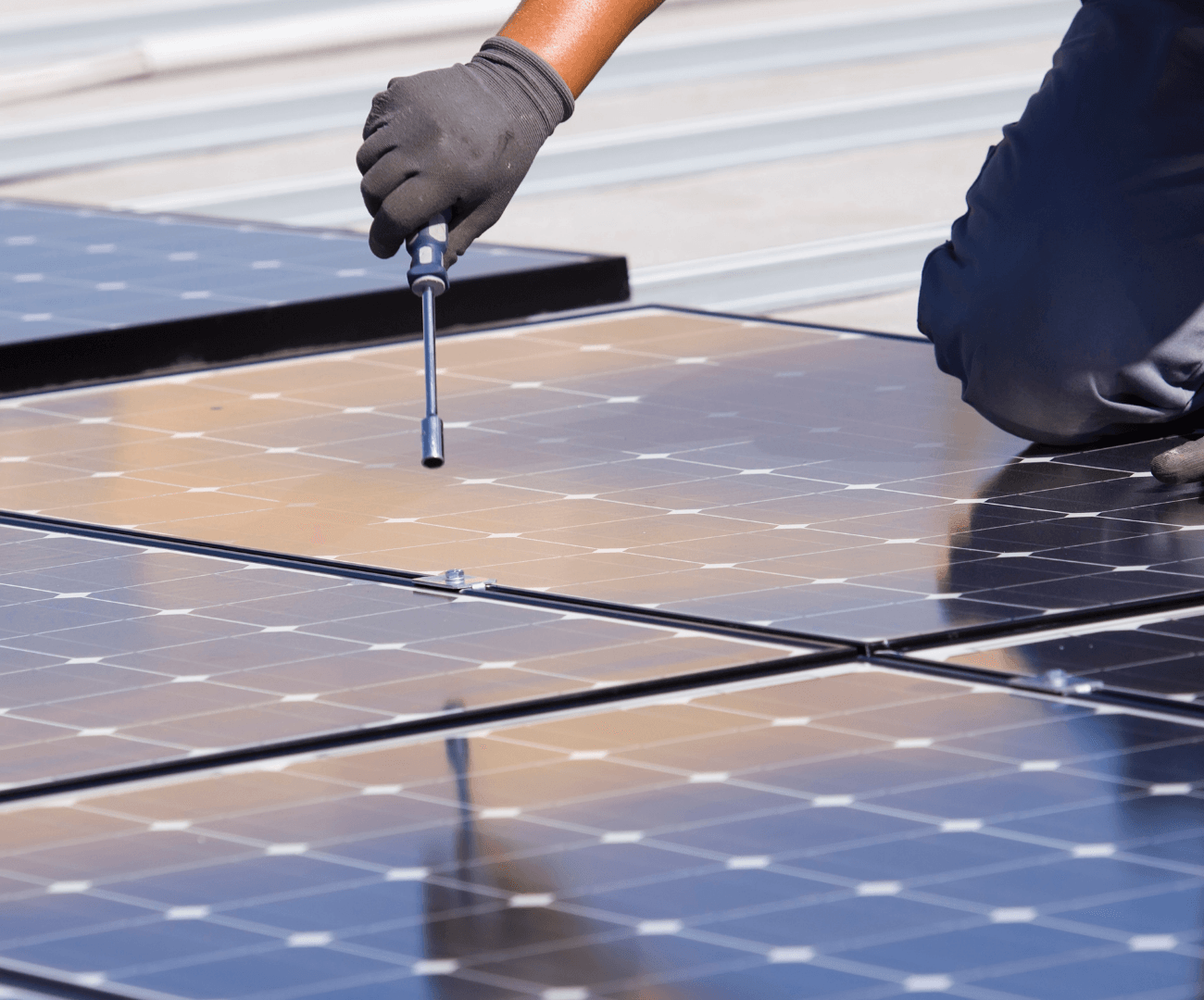

What to know about Solar Energy Rebates in Missouri

Homeowners in Missouri can take advantage of solar energy rebates offered by the following organizations:

Columbia Water & Light

Renewable Portfolio Standard requires that utility companies meet certain standards and they are offering exciting incentives to encourage Missouri Homeowners to go solar. Those switching to solar can expect some impressive savings and earnings. Solar homeowners partnering with Columbia Water & Light can collect as much as $625 per kilowatt of generated solar energy with a capacity of up to 10kW. There are additional rebates available for larger systems.

Kansas City Power & Light

Net metered solar homeowners working with Kansas City Power & Light can receive rebates of as much as $0.25 for each watt of solar energy generated in their home. The rates offered in this rebate program will be very different depending on the date of your applications. Make sure you contact the utility to confirm you are eligible for this rebate.

Ameren Missouri's Solar PV

Are you a solar homeowner and a customer of Ameren ? If so, you can take advantage of a very attractive rebate offered by your utility after you have installed your solar panel system.

The value of your rebates will be different depending on the size of the system and the type of installation you have in your home. Ameren customers can expect $0.25 per watt simply for installing their solar panel array. For an average 8kw system, this comes out to an extra $2000 saved.

The solar energy incentive is capped at 25 kW for solar homeowners, and 150 kW for owners of solar commercial and industrial locations.

Liberty Utilities

Much like the Ameren rebate we described above? Liberty Utilities offers a very similar rebate. This means you could take advantage of a rebate of around $0.25 per watt on your installation costs. This is about $2000 for the average system.

Which are the most advantageous, and by advantageous we mean lucrative, Solar incentives in Missouri?

Solar property tax exemption — not only do solar homeowners in Missouri enjoy cash rebates off the installation of their solar appliances, but they are also exempt from the property tax hikes that come from the installation of these solar power arrays.

The federal solar tax credit — there are also federal solar incentives. Investment Tax Credit will allow you to lower the costs of the solar energy system by as much as 26%. This only applies to those who have installed the PV system outright as with a cash purchase. Furthermore, you will have to have a high enough income to make the tax credit meaningful.