Why Your Business Should Go Solar

Here's Why You Should Consider Switching Your Business To Solar

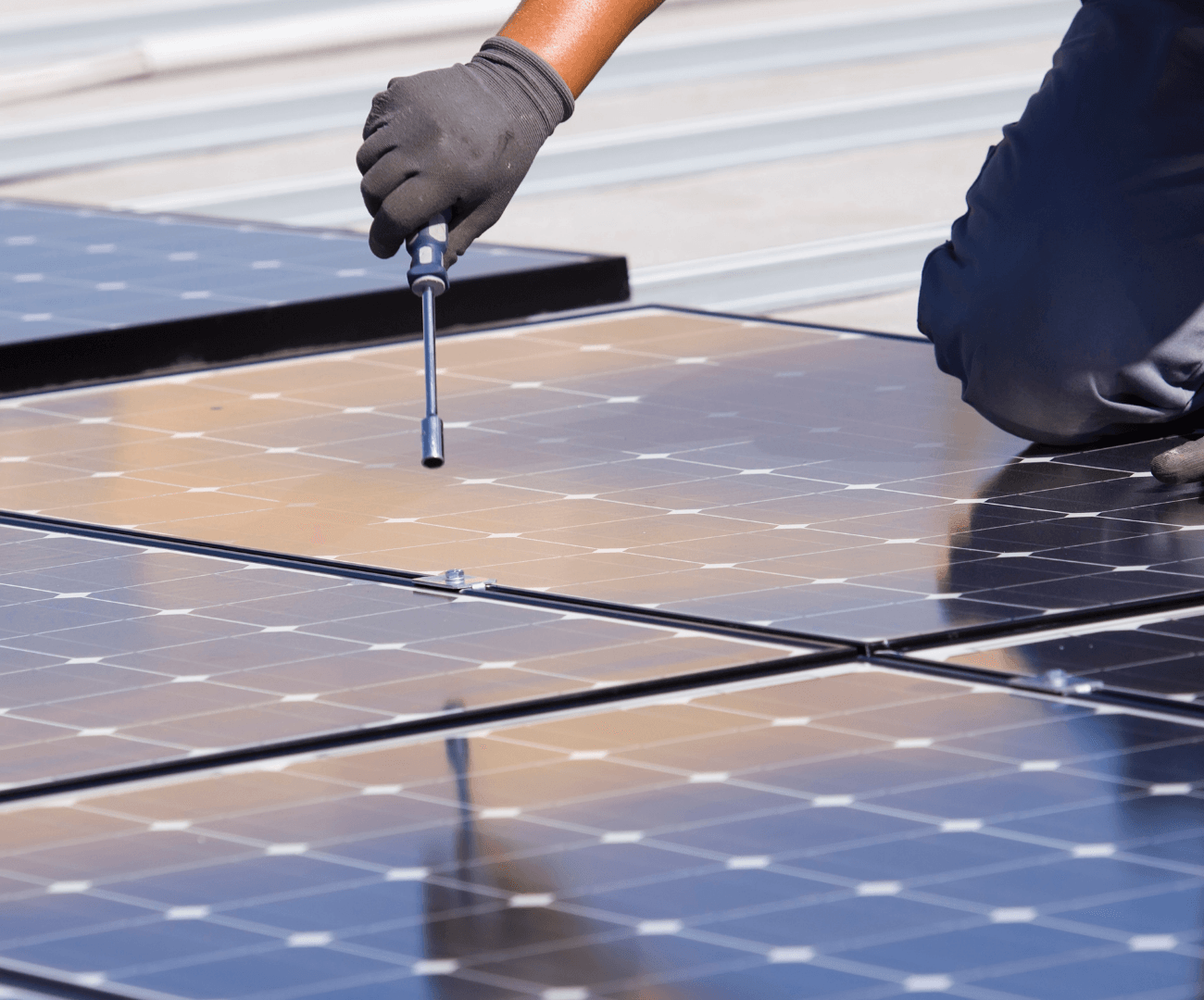

The solar power industry has matured considerably over the last few years. And thanks to advances in solar technology, solar energy is now one of the most affordable solutions available. Compared to other electrical system options, solar power is more reliable, dependable, and cost-effective. It also is one of the most economical backup power options available today.

If you want to keep up with the times as a business owner, then it’s high time that you took advantage of commercial energy systems such as solar panels. The good thing about solar energy is that it offers excellent pay-offs, especially considering the number of financial incentives the federal and state governments offer for solar conversions. According to the Solar Energy Industries Association, the sector is currently abuzz with activity with reports indicating that businesses across the country installed 14.5 GW (gigawatts) worth of solar infrastructure in 2017 compared to 7.5 GW (gigawatts) in 2015.

The Benefits of Solar Power for Businesses

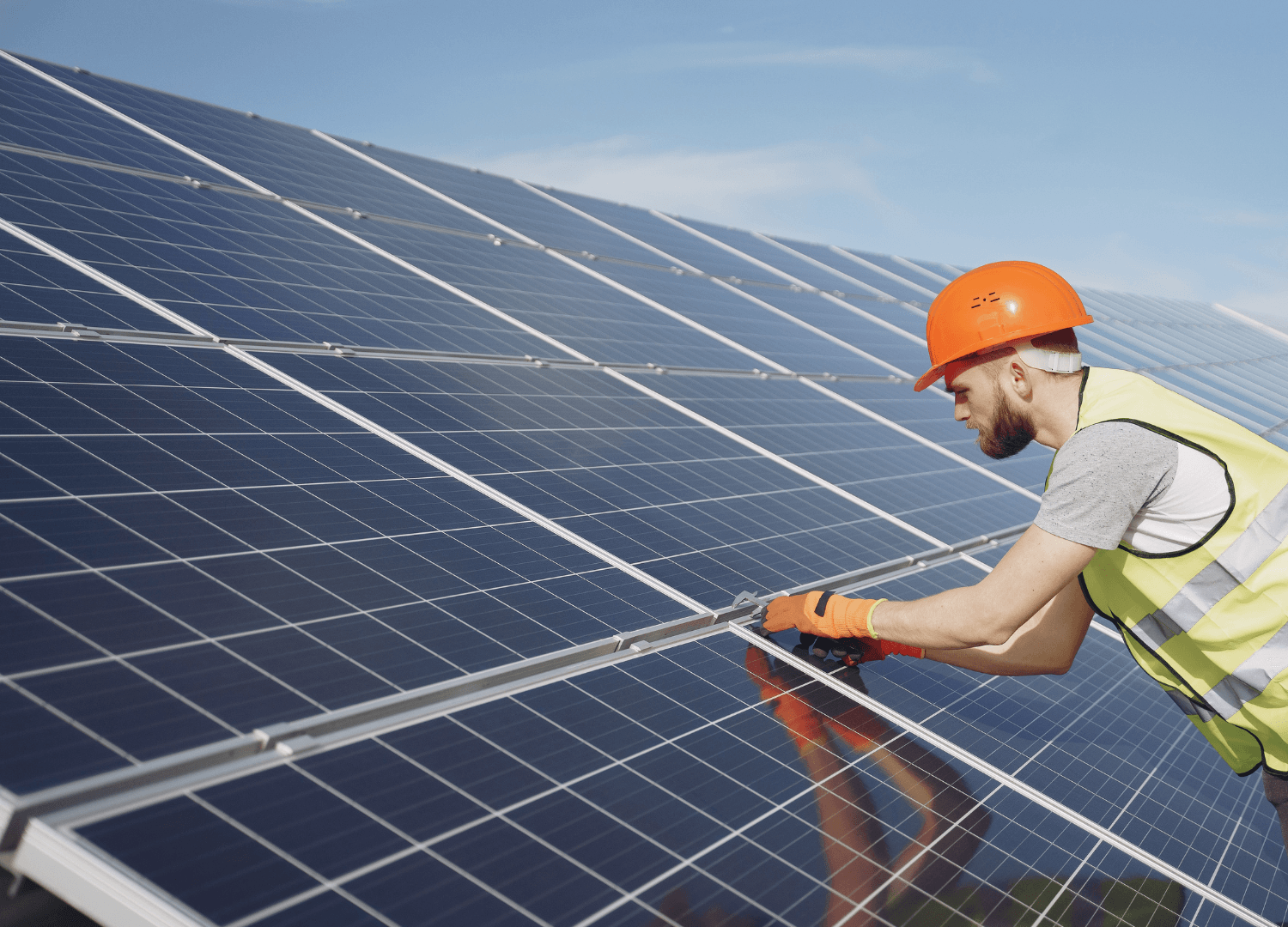

Converting a business to solar energy is not something that you do hurriedly. Before starting the process, it’s vital that you first assess your current energy needs and where you’d like to be in the long run. Like any business venture, you need to first weigh your pros and cons. As a business owner, you need to understand that investing in solar power is something that will take time before you see any decent returns. If you are thinking of converting to solar power, here are several benefits for you to consider:

Going solar:

- Helps cut overhead costs

- Offers great tax benefits

- Creates energy independence

- Has future longevity

- Offers continuous environmental and financial returns

These are some of the benefits that converting to solar power has to offer and five good reasons why you should consider switching to solar energy. By going solar, you will not only be doing the right thing for your business in a financial sense but also environmentally. Now, let us take a more in-depth look at how businesses can benefit from solar power.

Every business needs a consistent energy supply. Depending on your facility or office, you will need electricity to power more than just lights. Chances are you have electric cooling and heating systems as well as equipment or machinery powered by electricity. With each electrical device demanding energy to stay on, there is so much you can do to ensure that all your equipment and machinery keep running. With so many things relying on power, the biggest challenge is to find a way to reduce your overhead power costs.

When switching to solar energy, you need to first consider your needs – are you looking to minimize your dependency on your local power grid or to replace as much of it as possible. Unless you’re looking to go fully solar with a generator for backup, you will still be tied to your local grid for power during the night and additional support. However, whichever way you go, you will still see a considerable drop in your business’s overhead costs and will continue to benefit from the savings a solar conversion offers.

Another thing about solar power is that it also provides financial reassurance. Relying on solar energy, be it partially or fully, can help protect you from inflation and billing spikes. Depending on your local power grid means you are at the mercy of your power provider's supply shortage or seasonal cost increases. Converting to solar also protects you from inflation considering that commercial energy bills keep soaring with each passing year.

Here are the main tax benefits you will receive when you switch your business to solar energy:

26% ITC (Federal Investment Tax Credit) Relief: This tax relief by the federal government offers business owners a 26% rebate on the total cost of their solar power systems. For example, if you used $20,000 to have your solar system installed, you should expect a $5,200 tax credit. Furthermore, the program has no limit; so, even if you invest more in solar power, you’ll still be eligible for the 26% tax rebate. However, it’s worth noting that the benefit amount will start to decrease after 2022 – it’ll decrease to 22% in 2023 and then to 10% afterward.

Accelerated Depreciation: You are also eligible for accelerated depreciation on the solar power equipment you buy thanks to another federal government-run program called MACRS (Modified Accelerated Cost Recovery System). While the standard equipment depreciation tax deductions typically spread over the lifespan of the products, the program allows business owners to write off their overall solar panel system within one year. This not only helps improve cash flow but also gives you the ability to finance the installation of your solar power system.

SRECs (Solar Renewable Energy Credits): This option allows business owners to recover the cost of equipment installation by using the energy produced by their system. According to the government, 1 SREC is equivalent to 1,000 kW-hs. The interesting thing is that the government makes it mandatory for companies that produce electricity to participate and honor each credit you produce using your solar energy system.

These tax benefits are not something that you enjoy by installing a specific size or type of solar system in your business. They are incentives that are guaranteed by different federal government programs and whose purpose is to encourage more businesses to adopt solar energy irrespective of the kind or type of solar system installed.

Investment with Continuous Environmental and Financial Returns

While the cost of installing a solar system might initially seem exorbitant, this is one investment that’ll continue to help and improve your business's bottom line. Your system (depending on how big it is) can pay itself off in a few years as you benefit from low to no-cost electricity. Businesses, both big and small, are finally seeing that investing in a solar panel system is a great strategic decision as it guarantees them solid and consistent financial returns for years to come.

A solar energy system can also help your business attract more customers as most people are attracted to commercial establishments that are devoted to sustainability. Just imagine, the CO2 offset of a single 105-kilowatt system in three years is equivalent to saving 11,004 trees and 49,522 gallons of gas.